Insurance

Insurance companies spend a significant amount on physical documentation to execute their various activities, from issuing new policies, changes in the policies if they occur, contract signing, and claim processing. After the announcement of IRDAI on 24 April 2020, listed insurance companies can proceed with KYC online verification using UIDAI to verify Know Your Customer details for their customers. With the help of Meon eKYC service provider, you can cut your onboarding expenses by 90%.

- Incorporate e KYC online into your workflow that helps to prevent fraud and money laundering and boost the insurance service infrastructure.

- Insurance companies can use the UIDAI database to verify their customers' identities and addresses without any physical verification process.

- If a customer's mobile number is linked to Aadhaar details, they can initiate a KYC update online using a one-time password.

- Insurance firms can speed up their customer verification process using convenient and robust online procedures with legal boundaries.

- With a Digital KYC update online solution, insurance firms can rest assured that unauthorised persons will never misuse their customer information.

Hospital

eKYC is an umbrella term that covers comprehensive areas in various industries, including healthcare. E KYC online integration into the patient registration process facilitates hospitals' quick data collection and reduces the chance of errors in the hospital system. It is convenient for both administrations to manage their customer's data and for patients to save time on the initial verification process.

- By offering an agile and reliable way to register patients, KYC online verification elevates the healthcare departments' workflow and boosts efficiency.

- Implementing Aadhaar eKYC in the existing healthcare business infrastructure builds trust between the organisation and the patients.

- Incorporating an eKYC solution for hospital patients reduces the significant cost and time for identity verification.

- eKYC service providers let the hospitals avail the power of AI and machine learning to automate the verification process of their patients.

- Patients can verify their identity from a distance, adding a layer of convenience and accessibility.

Banking

Instead of visiting the physical bank branch, new customers can open their bank account using the KYC online service without presenting physical documents and multiple verification checks. In this process, the users must verify their identity through Aadhaar details, which is convenient and safer from unauthorised use. In addition, the new customers of the banks do not have to worry about sharing their sensitive information and reducing the waiting time.

- eKYC service providers enable financial institutions to verify customer information from a remote location faster.

- Aadhaar-based eKYC helps banks reduce the onboarding time for their customers and add more and more new account holders.

- Aadhaar KYC Online verification is based on OTP verification that prevents unauthorised activities in the banking system.

- After their consent, the document verification will proceed using the customer's DigiLocker account.

- The electronic KYC requires a few minutes compared to the tedious offline customer verification process.

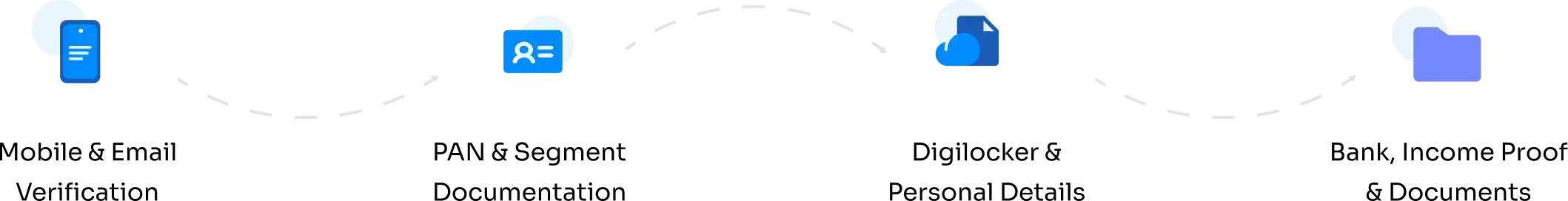

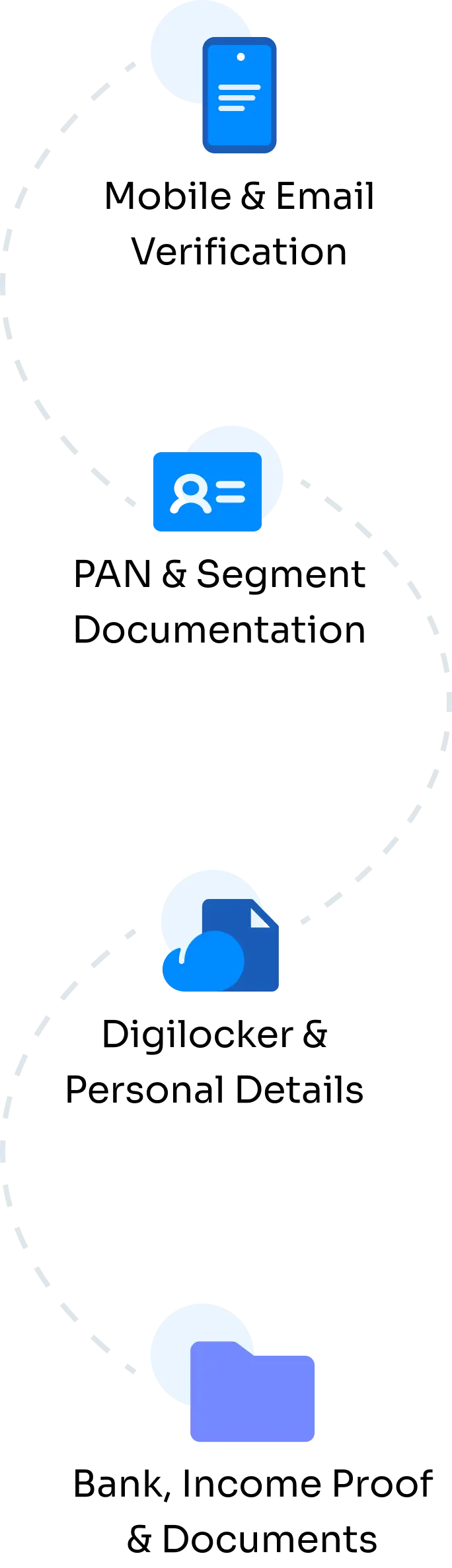

Capital Market

Whether users apply for a personal loan or invest in a mutual fund, they must go through a tight Know Your Customer procedure to access the services. The capital market businesses added the eKYC services into their existing business structure to provide faster and more convenient eKYC methods to open trading and demat accounts for their customers. With UIDAI database access, brokerage firms can verify the user's identity and authenticity in real time.

- Brokerage firms leverage advanced technology to gain a competitive edge through more agile, scalable, and reliable verification methods.

- A secured verification method contributes to a safer financial inclusion procedure and prevents fraud.

- Aadhaar eKYC services accelerates the Know Your Customer process within a few minutes and hours rather than days or weeks to complete.

- Brokerage companies do not worry about their financial restrictions and compliances and prevent the chance of any penalty.

- eKYC solution offers a platform for brokerage firms with two-factor and multi-factor authentication.

E-Commerce

Applying the KYC online method for e-commerce enterprises helps them verify consumer identities, boost security, and simplify the customer onboarding method. Embracing the eKYC service approach can be a game-changer for e-commerce businesses to thrive in their journey within the digital era and ensure safer transactions in the systems.

- Applying successful digital KYC adds an extra layer of security to e-trade structures.

- eKYC service providers offer a platform that strictly follows regulatory norms to prevent fines and unexpected penalties.

- Advanced Aadhaar eKYC verification methods mitigate the risk of payment fraud and prevent cyber-attack threats.

- Implementing digital KYC software into your existing business system ensures secure financial transactions.

- eKYC solution provides seamless ID checks, eKYC and AML compliance and offers an efficient onboarding facility.

Manufacturing

The Meon eKYC solution simplifies the customer identification process for manufacturing companies in India by reducing manual intervention and getting a seamless integration. Leverage the power of the advanced eKYC method with an advanced face-match algorithm, detect fake IDs, reduce operational costs, and boost customer satisfaction.

- Only an authorised person can access the eKYC service facility through a registered mobile number linked with Aadhaar.

- Aadhaar-based Digital KYC is considered one of the most secure verification processes for the manufacturing industry businesses.

- Collecting and verifying customer data through eKYC online is eco-friendly and reduces unexpected costs.

- Incorporating Aadhaar KYC Online verification into your manufacturing business reduces the burden on your employees.

- Businesses conducting online KYC processes for their customers experience greater privacy overall.

Real Estate

Hiring eKYC service providers is a new rage among real estate professionals and property management firms for various purposes. They use the KYC online service for tenant screening, lease agreements, and property transactions. In addition, it is a perfect way to make a streamlined identification verification process and prevent fraudulent activities.

- Connecting with a trustworthy eKYC provider helps you protect your real estate business against the risk of hefty fines and personal liability.

- A faster customer verification process keeps you at the forefront of the competitive industry.

- A quicker verification method leads to more business transactions in a secure and well-organised manner.

- eKYC uses advanced encryption and security measures for identity verification that set free businesses from data breaches and theft.

- eKYC in the real estate industry provides countless benefits, such as boosting accuracy and efficiency, reducing paperwork, and enhancing customer experience.

Hotels

Online eKYC process integration in the hospitality industry is crucial for hoteliers to verify their guests' identities to ensure they are genuine and their provided identity documents match accurately. These business professionals can hire eKYC service providers to simplify their electronic Know Your Customer process for hotel check-in and verification processes for car rentals.

- Integrate eKYC into online booking platforms where guests provide their personal information during reservation.

- Ensure eKYC processes comply with local regulations and data protection laws to safeguard guest privacy and security.

- Integrate eKYC services with the hotel's Property Management System (PMS) to improve operational efficiency.

- Online verification processes to authenticate the identity of guests and comply with regulatory requirements.

- OTP verification on registered mobile ensures that the person checking in matches the identity provided during the booking process.